To celebrate Financial Literacy Month in Canada, we’re bringing you a special post from Lauren Robilliard, our full time media and marketing manager from 2021 – 2024. Lauren shares a very personal story with some interesting financial implications:

November 1st marked the start of Financial Literacy Month in Canada.

November 1st was also the date I was adopted when I was a baby. You may be thinking “those two events don’t have any overlap”, but indeed, they do, due to the unexpected financial implications of DNA surprises and reunions.

I went through my own reunion with my biological families in 2018 at the age of 20. Because my parents made the wisest investment, and raised me to be financially independent and money smart for life, I was able to handle the financial aspects of it well.

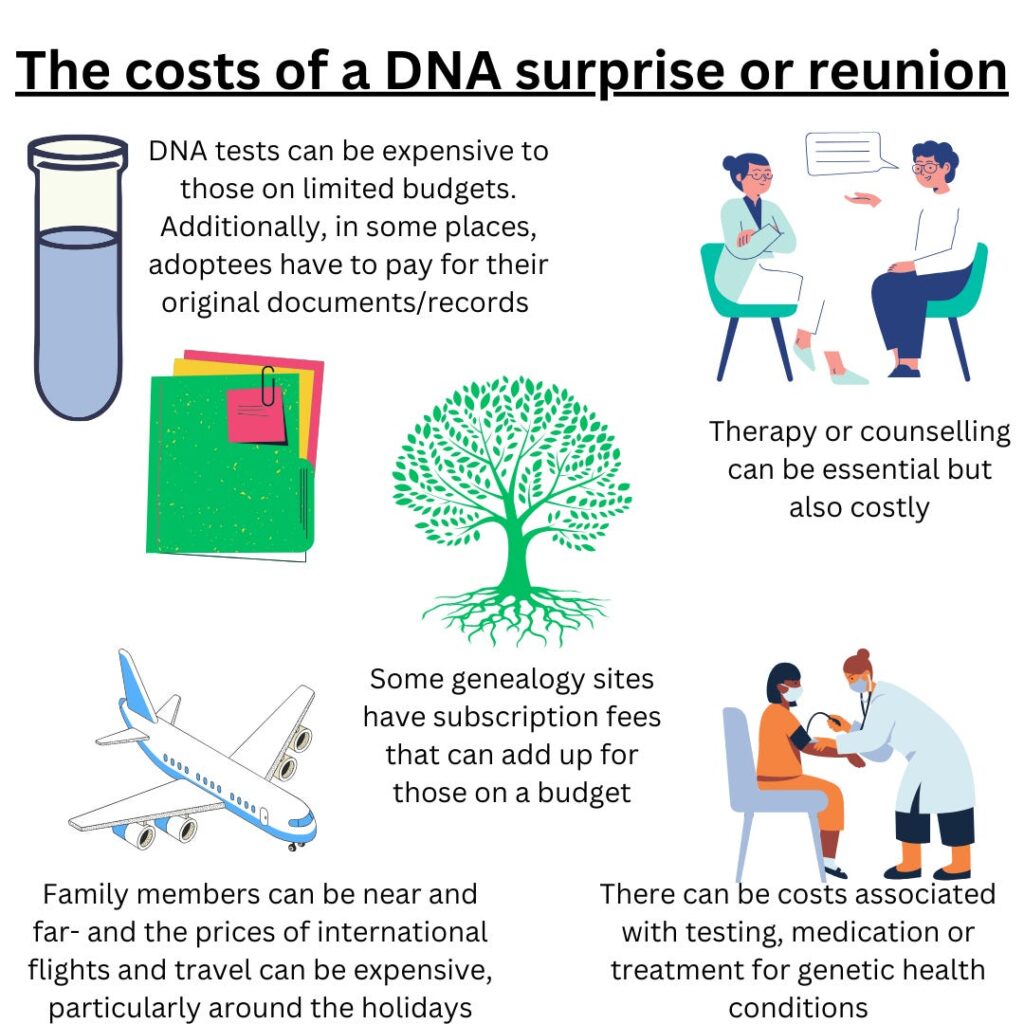

While I always knew I was adopted, many individuals discover their adoption status later in life. Or, people might face Non-Paternity Events (NPEs) after doing a DNA test. Both of these kinds of revelations can bring about unforeseen financial costs, and it’s very helpful to be financially literate to navigate them as best as possible.

In addition to the emotional and personal aspects of these reunions, there are the financial aspects that arise. You never know where your new family may live, and travel expenses to meet newfound family members can add up quickly!

In my case, I had to fly across the world to Australia to meet my biological mother and siblings. In fact, I flew there twice in six months! Luckily I had some savings from my part time job at Noodlebox, and I was able to pay for one of the trips entirely on my own. The rest of my new-found family lived on the mainland of British Columbia, and since I grew up on Vancouver Island, it meant lots of ferry trips back and forth to meet everyone.

Therapy sessions may become necessary to help individuals and families cope with the emotional aspects of these life-altering events, which can also be an unexpected financial commitment. Although costly, it was beneficial to me in the year following my reunion.

There might be additional genetic testing after the surprise or reunion too, if you learn that there are certain genetic conditions that run in your family.

Financial Literacy Month encourages us to prepare for such unanticipated financial challenges, and reminds us of the importance of budgeting, saving and understanding how to manage our money effectively.

The other fascinating part of Lauren’s story is that her DNA reunion inspired her to pursue courses and certifications in the field of genealogical studies. The skills she developed to search for her biological family, and help others do the same, eventually led her to launch a career as a forensic genetic genealogist with the Toronto Police Service, helping detectives solve cold-cases!

Coming Up!

On Friday November 22 at 10:30 am EST, I’ll be participating in a round table conversation on RealTalk with Ryan Jespersen to mark Financial Literacy Month.