Did you know that it’s Mental Health Week in Canada, and that May is also Mental Health Awareness Month in the US?

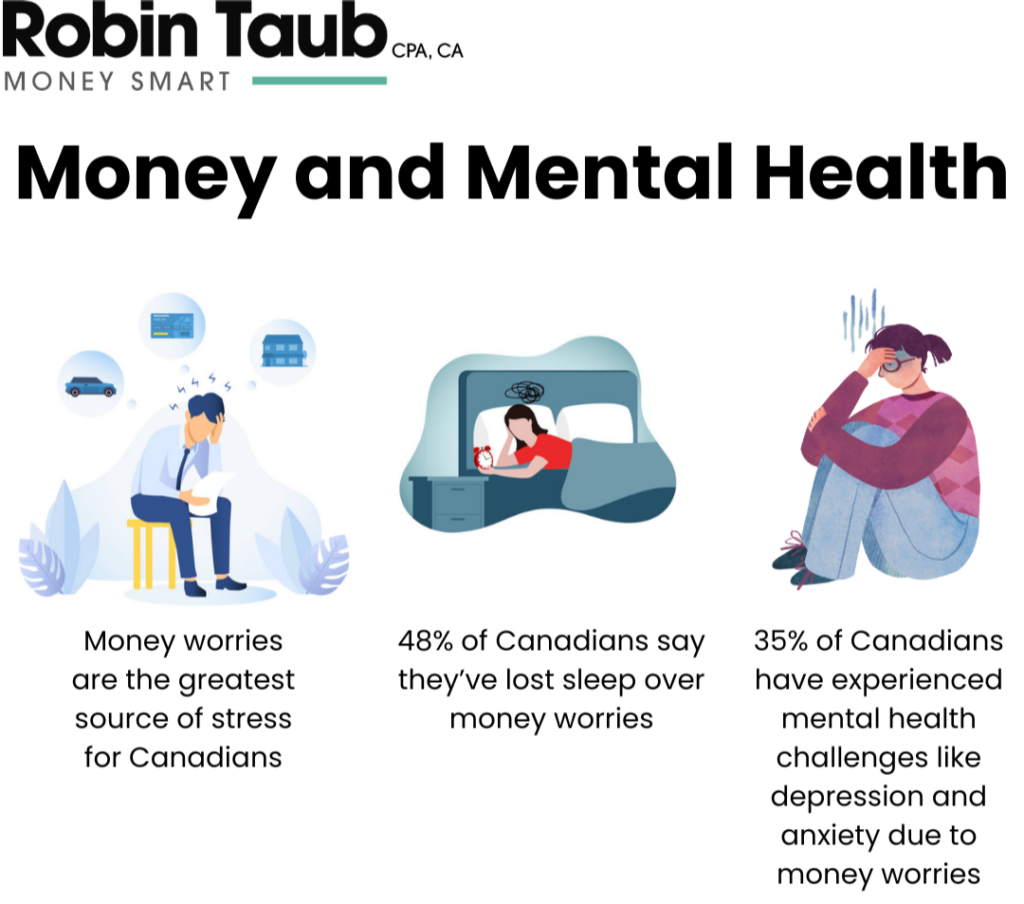

- According to a 2023 survey, money worries are the greatest source of stress for Canadians, more than work, personal relationships, or health – for the sixth year in a row.

- Research also found that money worries are the number one stressor across all age groups for Americans.

- Almost half (48%) of Canadians (and more than half of Americans) say they’ve lost sleep over money worries and 35% have experienced mental health challenges like depression and anxiety.

- Stress and anxiety can even make you more vulnerable to fraud.

Although we’re focusing on mental health this month, financial stress can also lead to physical health problems like heart disease and high blood pressure, as well as other ailments, such as migraines, compromised immune systems, digestive issues and more.

And in a vicious cycle, health issues may lead people to spend even more money on medical needs, such as medications, treatments and therapy, or on unhealthy coping mechanisms, like overeating, abusing alcohol or drugs, and smoking. If you’re already in a tight financial situation, this just adds to the stress.

Taking steps to improve your own financial health can lower stress and anxiety levels and lead to better physical and mental health, reversing the vicious cycle into a virtuous cycle. When your own financial house is in order, you can lead by example and be a good financial role model for your kids, helping them avoid some of the negative consequences of poor financial health in their own lives.