If you resolved to teach your kids about money this year, do you need to use family fintech apps, or is it just a want?

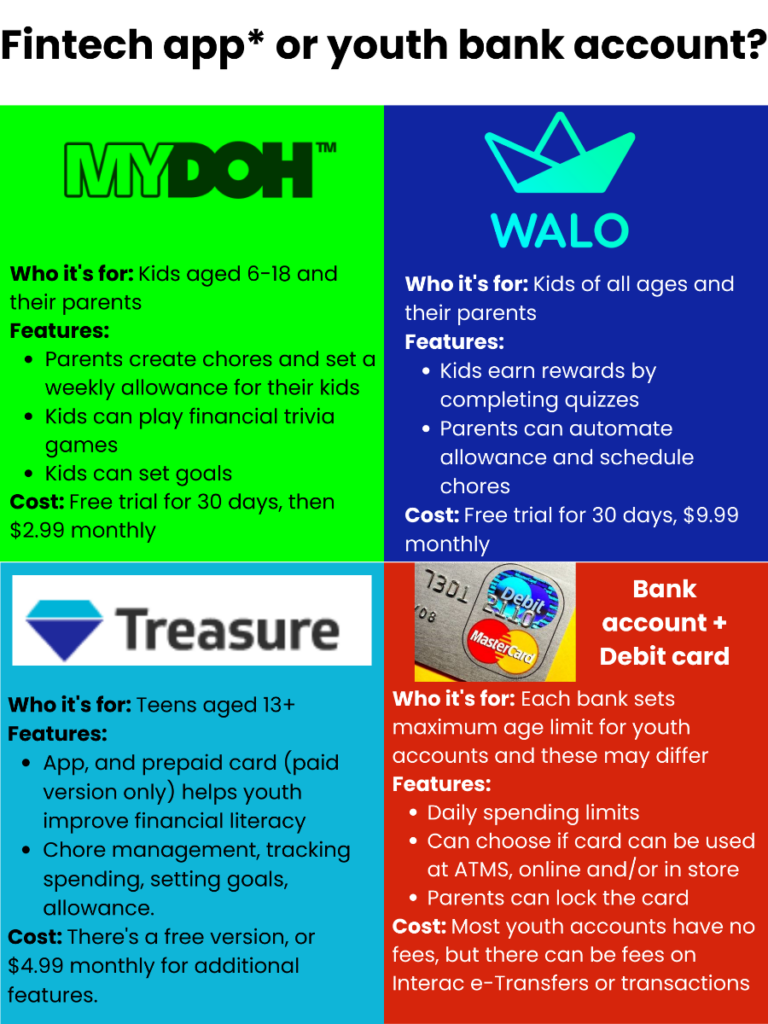

Last year, we discussed how family fintech apps can make allowance less of a chore, and help your kids spend responsibly using a reloadable digital and physical prepaid debit card (more details in the infographic below. For our US friends, check out Greenlight or GoHenry):

- it’s similar to a gift card, but can be used more broadly

- someone needs to “load” it

- you can’t deposit cheques or cash

- it stops working when it runs out of money (until “reloaded”)

According to research, digital tools have the potential to be a catalyst for financial education, particularly among young people, who are avid users of apps. Some of these apps have built-in financial trivia games or educational modules where kids can earn rewards by completing quizzes. But all of this functionality and convenience comes at a cost in the form of a monthly fee.

Alternative Solutions

So today we’re looking at an alternative for those who prefer DIY solutions. With a youth account and a linked debit card, you can “MacGyver” a solution yourself, by:

- creating a chore chart

- setting up weekly or monthly online transfers for allowance

- reviewing your kids’ transactions with them regularly

- setting alerts and notifications for real-time transactions

As described in the infographic below, youth accounts offer a more comprehensive banking experience (e.g. depositing cash and cheques) and are generally opened with parents or legal guardians, allowing you to retain some control.

Kids want to learn about money, and not just from apps, school, and the school of hard knocks! Research show that kids want their parents to teach them. A recent study by the OECD found that teens who talked with their parents about finances – even just once a week – scored higher on a test of financial skills than those who didn’t.

Whether you choose to use an app or not, the best solution is the one that sparks ongoing conversations with your kids about the Five Pillars of Money: earn, save, spend, share and invest.

Podcast alert!

- I joined Robbin McManne (yes, she spells it with two “b”s!) on Parenting our Future, to discuss having “the money talk” with your kids. Robbin also tackles other important topics on her show like sex, fear and anxiety, and #safesocial. Listen here or wherever you get your podcasts.

- I made my fourth appearance on Moolala with Credit Canada’s Bruce Sellery, to discuss this very topic of family fintech apps vs youth accounts and debit cards. You can listen to the podcast or watch it on YouTube.

Last but certainly not least, we are thrilled that January 2023 was the best month to date for sales of The Wisest Investment! Our sincere thanks to all of you who have bought books, told your friends and colleagues, left a review on Amazon or posted about the book on social media!