“Why isn’t financial literacy taught in school?”

That is the number one question I get from parents. And they’re usually shocked when they’re told that it is being taught in school!

After two years of pandemic disruptions, kids are back in the classroom. In Ontario, where I live:

- Students in grades one and up will be prepared for a digital world and fast-changing economy by learning about personal finance, coding, and a renewed focus on STEM.

- The grade 9 math course was updated last fall to include financial literacy, and a focus on topics such as debt and responsible credit card use.

- Grade 10 students are taught financial literacy in the careers course, including budgeting after high school and paying for post-secondary education.

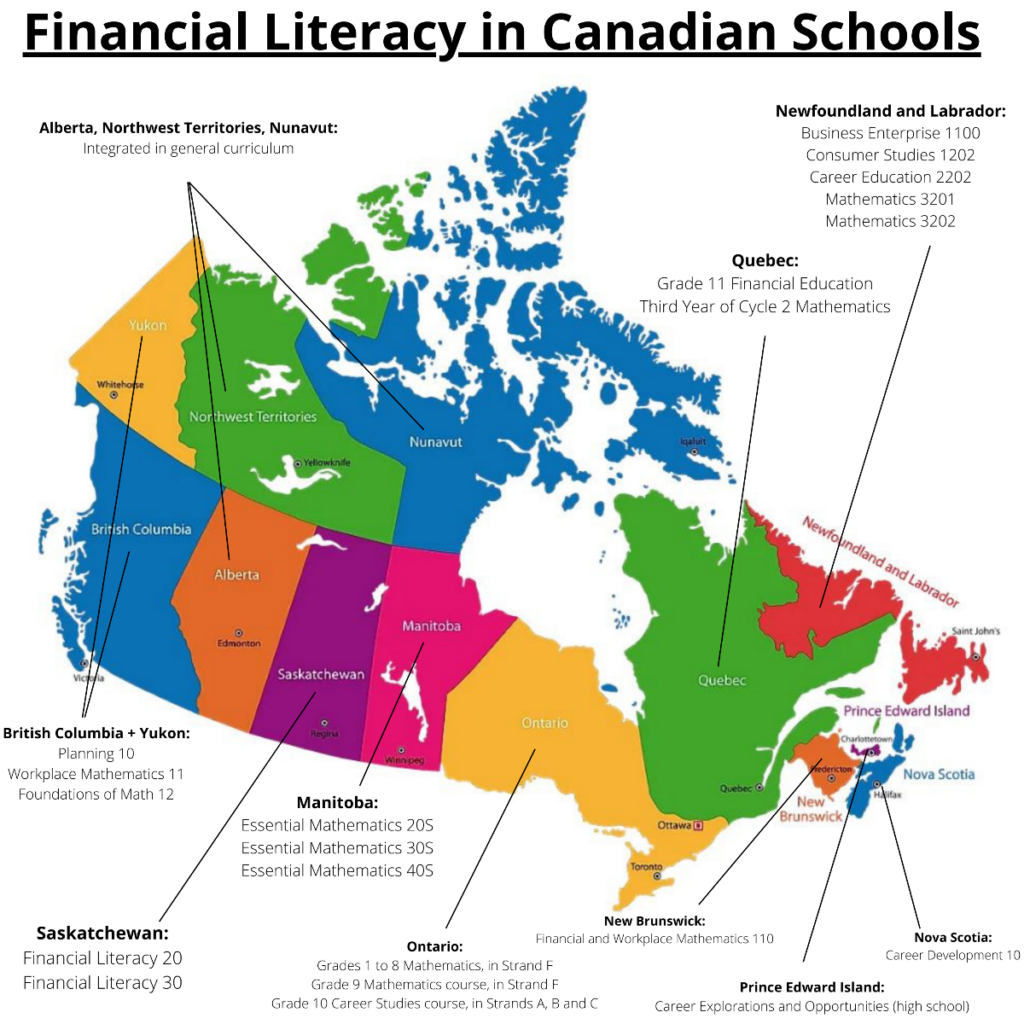

- Other provinces and territories have similar courses that teach students about money.

As parents, guardians, aunts, uncles or grandparents, how can you build on that knowledge outside of school?

All the best for the new school year!