Imagine a not-too-distant future where you don’t have to worry about your kids, because they’re responsible, independent and money-smart for life. As parents, we know that teaching our kids about money is critical to success in life. So important, in fact, that November is officially Financial Literacy Month in Canada.

But many parents feel they lack the time, knowledge and experience to teach it well. Add the seismic shift toward a cashless, digital society – accelerated in our post-pandemic world – and it’s easy to feel overwhelmed. How do you know what to teach your kids about money at each age and stage?

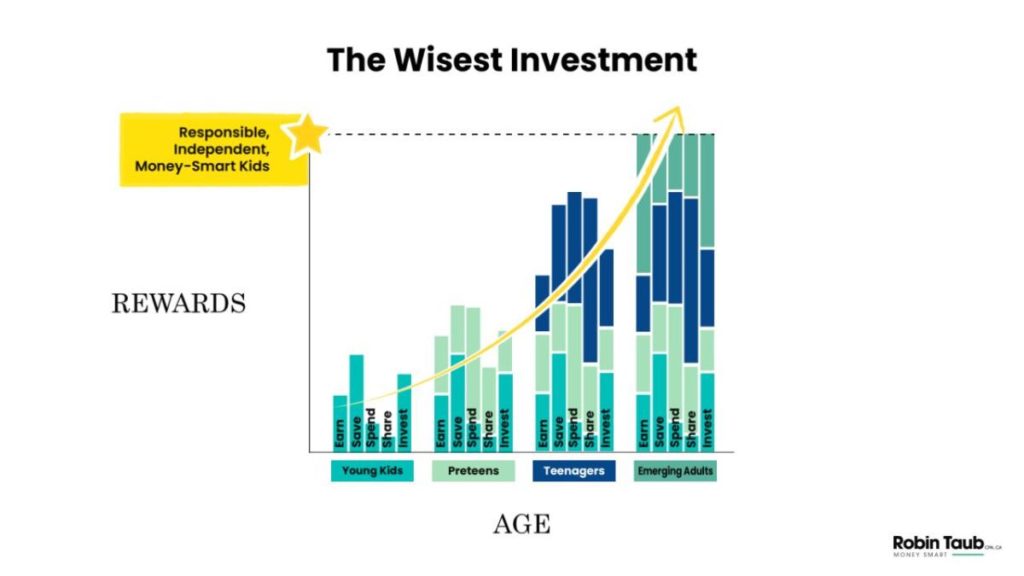

To help put you at ease, I created a framework – a little “cheat sheet” below to help guide these conversations, using the Five Pillars of Money.

As you can see, the Five Pillars of Money, Earn, Save, Spend, Share and Invest, never change. But as your kids get older, the specific topics and examples for each of the Five do.

Try to start teaching your kids when they’re young, laying a foundation you can build on. (If you’re looking for specific tips for young kids, check out this post on LinkedIn.)

What if you haven’t started yet, is it too late? Definitely not, and you don’t have to go back to the earliest stages. Instead, jump in at the stage your child is at currently, to ensure the information you share is age appropriate.

Each week of Financial Literacy Month, we’ll be updating the tips for the next age group. You can stay up to date by connecting with me on LinkedIn, and you’ll find much more, including practical examples, suggested activities, worksheets and self-assessment tools in The Wisest Investment: Teaching Your Kids to Be Responsible, Independent and Money-Smart for Life.